Its complicated. The most up to date information will be on the government website https://fincen.gov/boi As of today the filing is voluntary. The federal courts are still trying to determine if the Corporate Transparency Act is constitutional. You may have … Read More

Amazing Service

Our client solutions are driven by a unique, strategic-focusing process. A proven, systematic, and structured method for clients to achieve greater results in their businesses.

Personal Tax Preparation

Personal tax returns with W-2s, 1099 Retirement income, independent contractors, Schedule C filers, Schedule E Rental properties, and complex brokerage accounts, and crypto, and other alternitive investments.

Tax Relief

If you have unfilled tax returns, or owe the IRS back taxes, now is the perfect time to get caught up before it creates more problems in your life.

Business Tax Preparation

For small and large businesses, we prepare partnership, LLC, S-Corp, and corporate returns, monitor growth, profit, and risk ensuring the appropriate management.

Payroll Tax Help

The IRS aggressively enforces payroll taxes. On top of taxes owed they can enforce a trust fund recovery penalty that can be 100% of the taxes owed thus doubling what you need to pay. You don't want to go this alone. Hire us to negotiate with the IRS and lower the amount you owe.

Financial Planning

Personal financial planning insurance, investment, income tax, retirement, and estate planning, including real estate on a project or hourly rate; not on commission.

Real Estate Tax Help

We are pleased to help real estate agents with their tax planning and structuring. We also work with real estate investors on a per project basis or as part of their overall financial plan.

Tax Returns Done Right

- Consultation

- Print and e-file

- Includes your W-2 tax forms

- Maximize tax deductions

- Online access to all tax returns on file upon request

- Amended included

- Notices included

- Consultation

- Print and efile

- *Includes personal tax return*

- Maximize tax deductions

- Quarterly Filings

- Online access to all tax returns on file upon request

- Amended included

- Notices included

- Back Taxes

- Offers in Compromise

- Unfilled Tax Returns

- IRS Negotiations

- Payroll Tax Relief

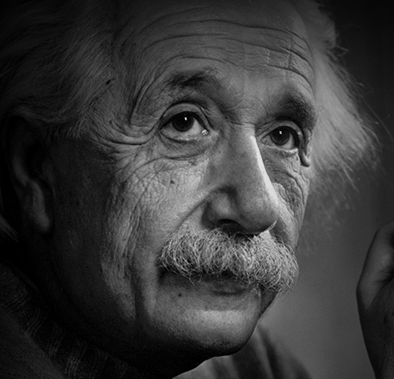

Kyle Dugan EA CAA

I’m an Enrolled Agent that takes great pride in offering my clients the highest level of service in order to assist them in achieving their personal, business, and financial goals.

As a licensed professional through the Treasury Department, you are assured that I participate in mandatory professional development, have regular practice compliance reviews, carry professional liability insurance, and conduct business under a strict code of ethics.

I am an experienced EA who can advise you on the tax and accounting challenges that you and your business may face.

I view every client relationship like a partnership, and truly believe that my success is a result of your success.

Why Me

My client solution is driven by a unique, strategic-focusing process. A proven, systematic, and structured method for clients to think, plan, monitor and achieve greater results in their businesses and lives.

Take Charge of Your Business Today

My client solution is driven by a unique, strategic-focusing process – a proven, systematic, and structured method for clients to think, plan, monitor and achieve greater results.

Tax Articles

December’s Real Estate Corner

Real estate deals falling through can be a frustrating experience for home buyers. In fact, statistics show that approximately 10 percent of real estate deals do not reach closing. However, there are steps that buyers can take to prevent this … Read More

Round Up Those Receipts: Your Ticket to Tax Savings Awaits!

I hope this finds you enjoying a fun-filled week between Christmas and New Years, but while a lot of folks are taking it easy, let’s talk about the elephant in the room—those pesky receipts that you’ll need to file your … Read More

Dip Into That Retirement Account?

Oh, the siren song of “just taking a little bit!” But is it really a bad thing? It’s part of the surprisingly difficult transition, as a retiree, from saver to spender. After all, you spent decades building up the … Read More

The Urgent Necessity of Organizing Your Receipts Before Year-End

Yes, it’s the last week of the year, and a lot of business owners have taken off this week to enjoy the holidays and their families. As the calendar year winds down to its inevitable close, you might find yourself … Read More

Harvest Tax Losses – How to Make Your Investments Do a Jig at Year-End!

It’s that time of the year again—yes, the holidays, but an equally festive period of harvesting tax losses. Yes, you read that right. Harvesting losses on investments can be like having your pie and eating it too, financially speaking. Let’s … Read More

“Locking” Your Credit This Winter

Freezing your credit these days can be relatively easy online and it can protect you from fraudsters looking to steal your identity and open credit cards in your name. If a criminal can get a credit card in your name, … Read More

Do You REALLY Need A Year-End Inventory?

As we approach the year’s conclusion, our attention is naturally drawn to various financial tasks that demand our time as business owners. While some of these tasks may not carry the allure of strategic planning or revenue generation, they are … Read More

Boost Your Future and Lower Your Taxes: Max Out Retirement Contributions

Time is of the essence as the year draws to a close, especially when it comes to securing your financial future. One action item that can’t wait is maximizing your contributions to retirement accounts like 401(k)s and IRAs. You see, … Read More